Awareness with YNAB

I’ve been using a budgeting service called YNAB for almost two years now and would like to share some of my thoughts on it.

The way I’ve handled my finances in the past has been in a pretty strict fashion. I took a rather big chunk of my monthly paycheck (maybe around a third or so) and put it away on a savings account. Then I lived through the month with the rest of the money I had on hand. Pretty simple.

By taking this away directly at the beginning of the month I grew accustomed to spend less, since I had to adjust my spendings after what money I had left. I never felt there was anything wrong with this type of approach and I managed to save a substantial amount by keeping to it over the years.

But then I stumbled upon YNAB.

It wasn’t like a revelation at first or anything but I’m curious in ideas that can provide me with extra value, without requiring too much effort from my side. So I started to try it out.

YNAB is actually not just a tool to keep track of everything you’re spending. YNAB is a systematic set of ideas to approach budgeting.

Virtual pockets of money

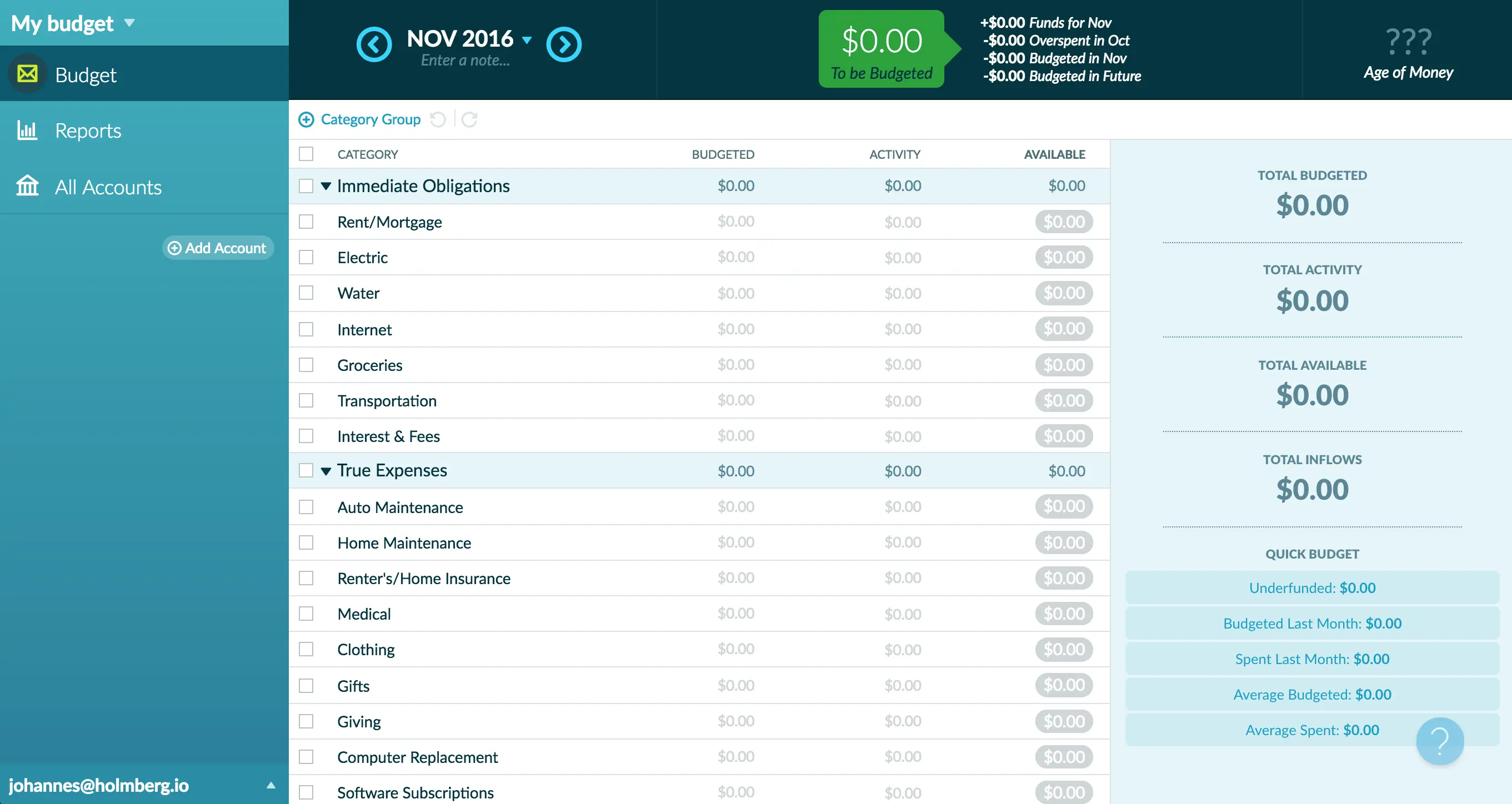

The heart and soul to this approach consists of categories, but I like to call them pockets. You initially set them up for your budget and then tweak them as you learn. I sat up a few expenses that I knew we have on a regular basis like “Rent”, “Electricity”, “Health insurance” etc. I also set up a few generic categories like “Fun money” (for eating out, going to the cinema etc.) and “Personal” (for all physical things, clothes, shoes and so on.)

When the categories were set up I started delegating my money to them.

Now this is something really cool. Because now I know what my money is doing. Before, I knew that for instance I had $5000 on my savings account (that also felt good, sure) but I never knew what that money was supposed to do.

My grandparents used to budget by putting money in different envelopes and then label them. This is the exact same philosophy, only that my money lives in these “virtual pockets”. It gave me a new clarity in how to handle my money.

Long term goals

After a few months of using YNAB, I started to figure out its real power—setting priorities. I can set up any goal I want and start budgeting my money in order to achieve that goal. No matter how big or small it is.

One thing I knew I wanted to buy in a later stage was a bicycle. I didn’t need it right away but wanted to have the money ready for when I was. So I put up another category, or a pocket, and month by month dedicated a little bit of money to it. It wasn’t much, but now close to two years later I have over $1000 in there. Boy oh boy will it feel good to buy that bike in the spring.

Everything is a monthly expense

I started realizing that every expense I have can be broken down to a monthly expense. It makes it much easier to forecast my money. There is actually nothing like a “normal month” when it comes to expenses. Sometimes the insurance bill on the apartment for a whole year is comes popping up disrupting my “normal” month. Then I keep hoping that next month will be more “normal” but it never is. So instead of just dealing with these things when they come up I can break them down into monthly payments.

For example I pay for a discount card for all public transport in Switzerland. It gives me half price on all rides and I pay around $180 per year for this. I break it down to 180/12 and figure out that it costs me $15 per month. I create a category for it and allocate $15 of my income every month and the money will be there when it needs to be payed. It doesn’t eat a hole in any other parts of my finances and it gives me a sense of relief. The budget is doing the work for me.

The same goes for Christmas gifts. Let’s say I want to spend $600 on gifts for next years Christmas. 600 divided by 12 and I allocate $50 each month for this category. When Christmas comes around I will have $600 waiting for me. And it was all part of a “monthly expense.”

Location doesn’t matter

The beauty of this process is that I don’t need to shuffle around money between a lot of different bank accounts. In fact, I just need one account. The budget is telling me what the money should be doing. This way I always know what different parts of my money is dedicated to do.

Monthly priorities

Once every month, usually when the paycheck comes in, I will sit down and have a look over my priorities and see that I’m on track with my goals. This is also a good opportunity to reconcile my expenses to check so my bank account tells the same number as I have in my budget. Then I allocate my new money to their jobs for the coming month.

Summary

I am completely sold on the way YNAB handles budgeting. It’s super easy and fun to get started and the best thing is that I learn more about my priorities in the process. They shift, as life has a tendency to do. And it’s so frictionless to tweak the budget as needed. This is not a budget set in stone that I can’t touch after it has been set. This is a living, flexible thing that I can form into something that works for me.